Eviction is the Point | A Kin+ Investigation (Part 2)

Unmasking the System: Inside Columbus' Quiet Displacement Machine

COLUMBUS, OH – The notice arrived, stark and unforgiving, taped to the door. For the Taylor family, whose story of a leaky basement, persistent mold, and a battle over rent with Beacon Property Management & Realty, Inc. was first detailed in the Columbus Free Press and Kin+ Investigation report "Eviction is the Point," it wasn't merely a legal formality. It was, they allege, a calculated maneuver, a deliberate step within a system where the very act of filing for eviction can be weaponized.

Earlier this month, we revealed their struggle with a rental home owned by Brand Realty LLC and managed by Beacon—a struggle marked by over 18 months of unresolved maintenance issues, including two significant basement floods that left behind water damage and lingering mold, alongside a crucial breakdown in communication and payment attempts. Despite having funds set aside and actively seeking to negotiate a payment plan—even after their online tenant portal was allegedly locked—they received the dreaded three-day notice to vacate. This notice, a precursor to a formal eviction filing, landed despite their stated willingness and ability to pay back rent, minus certain disputed fees they believed were unwarranted given the uninhabitable conditions caused by the maintenance failures.

The most disturbing detail uncovered was an internal communication, purportedly from Beacon's operations manager, suggesting the eviction filing was initiated not solely due to an inability or refusal to pay, but with the explicit knowledge or intent that an active court case might trigger eligibility for emergency rental assistance programs like IMPACT Community Action.

“We filed because we know if you’re in the eviction process, IMPACT or another assistance program may be able to help you.”

— Internal email, Beacon Property Management

This chilling statement painted a picture of a potential strategy to leverage the crisis of eviction itself, using the court system as a deliberate pathway to unlock public funds while simultaneously subjecting the tenant to the devastating consequences of a legal filing and the immense stress and uncertainty that come with it.

A City Quietly Built on Eviction

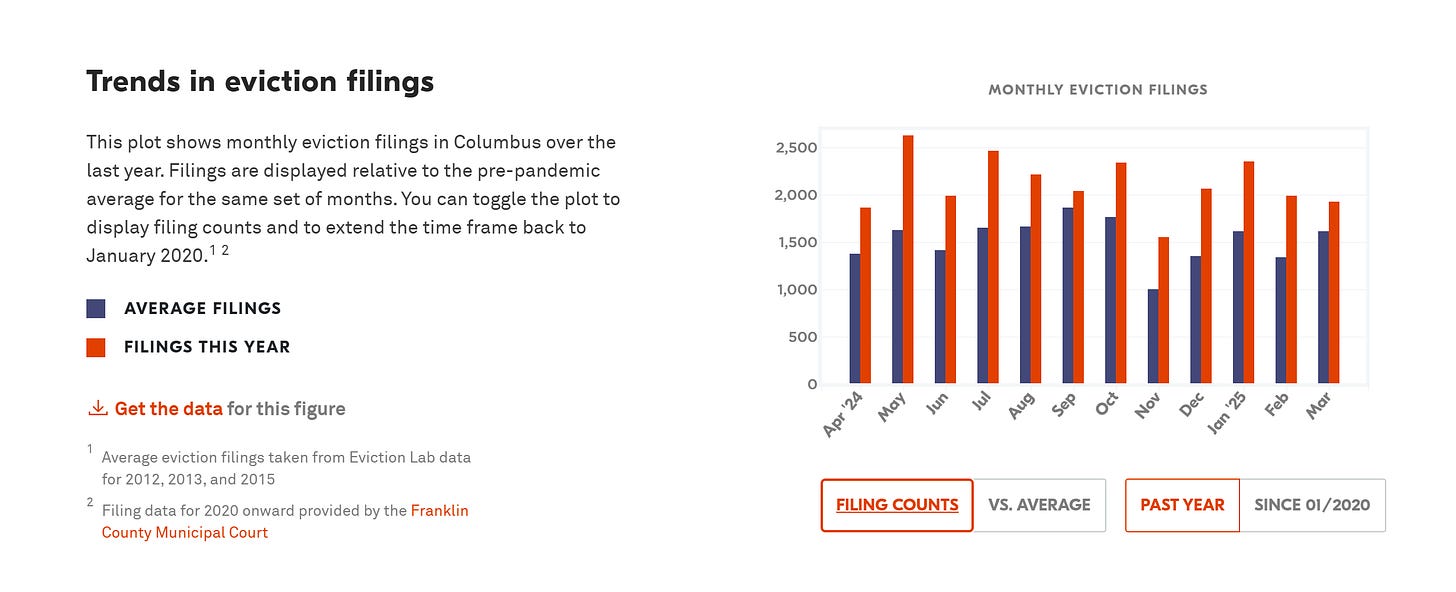

More than 25,000 eviction filings were processed in Franklin County in 2024 — a 6 percent increase from the previous year, and a grim marker of a housing market spiraling deeper into crisis.

But the surge is even more alarming when compared to pre-pandemic norms: eviction filings have jumped by more than 40 percent since 2019, according to the national research group Eviction Lab, which tracks filings across the country.

The pandemic’s federal moratoriums offered a temporary pause. But when those protections lifted, Columbus didn’t return to “normal” levels. It surpassed them — driving filings to some of the highest rates in over a decade.

And Columbus is not alone. Across the country, the eviction crisis is surging:

Cincinnati has seen a 34 percent rise in filings over pre-pandemic levels.

Kansas City filings have climbed by over 45 percent.

Atlanta, long labeled the eviction capital of the South, has returned to near-record levels, disproportionately displacing Black and working-class tenants.

Some cities, like Cleveland, have seen modest declines — a 31 percent drop — often due to aggressive right-to-counsel initiatives and stricter tenant protections. But Columbus stands on the wrong side of the ledger: a city where the machinery of eviction runs more efficiently — and ruthlessly — than ever.

Behind these cold statistics are corporate managers and private landlords who have redefined eviction not as a desperate last measure, but as an integral part of their business model — as standardized and routine as charging a late fee or sending a utility notice.

Yet the filings themselves reveal almost nothing about the wreckage they leave behind. An eviction notice marks only the beginning of a legal assault: it does not capture whether families were forcibly removed, pressured into surrendering their homes under duress, or narrowly managed to escape through dismissal. It merely certifies that the machinery of displacement has been set into motion — a machinery indifferent to negotiation, blind to hardship, and calibrated to grind faster than tenants can fight back.

In Franklin County, as in so many cities across America, the act of filing is not an aberration.

It is the point.

Ohio law grants landlords sweeping power to set this machinery in motion.

Under Chapter 1923 of the Ohio Revised Code, a landlord may issue a three-day notice to vacate for nonpayment of rent — with no legal obligation to offer mediation, accept partial payments, or even address unresolved maintenance violations first.

Once posted, the clock begins ticking: seventy-two hours.

Excluding the day of service. Excluding legal holidays.

Seventy-two hours to scrape together back rent, navigate complex rental assistance systems, seek out legal counsel — or somehow negotiate a stay of execution — if they are even afforded the dignity of a conversation.

For tenants from South Linden to Hilltop, from Franklinton to Whitehall, the story repeats with brutal consistency: conversations cut short, repair tickets unanswered, public aid applications still pending when the three-day notice lands on the door.

There is rarely time to fix the issue.

There is rarely time to explain.

And for landlords, there is no financial penalty for rushing to file — no barrier to escalation, no incentive for patience.

In fact, there is a perverse incentive: the very act of filing may serve as the golden ticket.

Filing an eviction often unlocks access to public emergency rental assistance programs like IMPACT Community Action — lifelines intended for tenants on the brink, but increasingly weaponized as fast tracks to landlord reimbursement.

In this distorted system, filing for eviction becomes not a desperate last resort, but a strategic maneuver — a calculated move to tap public dollars while externalizing the emotional, financial, and legal devastation onto the tenant.

The state built the machine.

The landlords learned to drive it.

And the families caught in its gears are rarely seen, rarely heard, and rarely spared.

The Real Landlord Stays Hidden

The true power behind the Taylor family's eviction — and behind dozens of others like it across Columbus — isn’t the property manager whose name appears in court records. It’s Brand Realty LLC, an entity operating almost entirely in the shadows.

Registered in Ohio as a limited liability company, Brand Realty’s structure is a blueprint for invisibility. The LLC model shields its principals from public scrutiny, insulating those who profit from rental income from the direct consequences of tenant hardship, maintenance failures, or legal action. There are no public-facing executives, no direct phone lines, no website to navigate complaints or demand accountability. To tenants, Brand is not a landlord. It’s an absence.

Instead, tenants interact with Beacon Property Management & Realty, Inc. — the public face of the private owner. Beacon signs the leases, collects the rent, issues the notices, and files the evictions. Brand collects the proceeds, hidden behind layers of corporate paperwork.

Through an ongoing review of Franklin County Auditor records, our investigation has begun mapping Brand Realty's ownership footprint. Early findings show a constellation of holdings across Columbus — primarily single-family homes concentrated in neighborhoods with long histories of racial redlining and economic divestment: Linden, Hilltop, South Side, Northland.

Some properties show troubling patterns: recurring code violations, persistent maintenance complaints, disputed late fees, and rapid legal escalation when tenants fall behind. The same homes where families experience flooding, mold, and neglected repairs are the homes being cycled quickly through eviction courts.

This deliberate obscurity isn’t a bureaucratic oversight. It’s the business model. Anonymity is the asset. The LLC structure allows companies like Brand Realty to operate as absentee landlords without reputational risk — to pursue profit maximization without bearing the public consequences of displacement, neighborhood destabilization, or community anger.

The tenants facing eviction never get to negotiate with the real decision-makers. They deal with property managers empowered to escalate conflict, but powerless to make systemic change. The people who own the doors tenants are being pushed out of remain faceless, unaccountable, and unseen.

And for families like the Taylors, that invisibility isn’t theoretical. It’s lethal.

The Eviction-to-Aid Pipeline

The Taylors' situation is not an isolated incident. Across Columbus, a growing number of landlords have learned to weaponize the very system meant to prevent homelessness — turning eviction filings into strategic tools to unlock public assistance dollars.

Housing experts and legal advocates describe a disturbing trend: filing for eviction not primarily to remove tenants, but to fast-track access to emergency rental assistance. Agencies like IMPACT Community Action, designed to intervene in true crises, are increasingly pulled into a system where the crisis is manufactured by design.

These programs — expanded dramatically during the COVID-19 pandemic and still active today — are often required to triage overwhelming need based on urgency. A formal eviction filing becomes more than a legal act; it becomes evidence. Proof of imminent loss. Proof that moves a tenant's case to the front of the line.

And landlords know it. They don't have to wait for a tenant to exhaust personal savings, plead for a payment plan, or navigate the slow bureaucracy of assistance applications. They can simply file, send the court paperwork to agencies like IMPACT, and position themselves to collect months of back rent — paid by the public — without ever seriously attempting to negotiate or resolve disputes first.

For tenants, the consequences are devastating and lasting.

A single eviction filing — even dismissed or resolved — creates a permanent public record.

Private tenant-screening companies scrape this data and sell it to landlords nationwide, flagging applicants as high-risk even when no judgment was entered against them.

Many landlords enforce blanket bans, automatically rejecting anyone with an eviction history, regardless of the circumstances.

A tenant who fought to stay, who paid their arrears, who complied with every demand — still carries the digital scarlet letter. It follows them through every future rental application, every background check, every desperate search for stability.

Meanwhile, the landlord walks away whole.

Paid in full. Fees intact. Business as usual.

There is no legal penalty for filing strategically. No consequence for using the court system as a funding mechanism. No accountability for the harm inflicted — on credit scores, on mental health, on families forced into unstable housing or homelessness by a filing that was never truly about removing them, only about extracting value from their vulnerability.

In Columbus, the eviction-to-aid pipeline doesn’t just exist.

It thrives.

And tenants pay the price — in public shame, permanent instability, and the loss of any presumption of security.

A Market Built for Displacement

Franklin County’s eviction crisis is not an anomaly. It’s a feature of a larger, engineered pattern reshaping the housing market across Ohio — a pattern where displacement is not a side effect, but a business strategy.

Across the state, corporate landlords and private equity-backed firms have rewritten the rules of property management. Companies like VineBrook Homes, a massive institutional landlord with thousands of scattered-site single-family rentals, have become synonymous with neglect, extraction, and legal aggression. VineBrook has been the subject of lawsuits by cities like Cincinnati, branded a public nuisance for widespread code violations and tenant complaints.

Their model is simple — and chillingly effective:

Delay or deny critical repairs.

Pile on administrative and late fees.

File early and often to trigger court pressure or public assistance.

Cycle tenants out when they become unprofitable.

What tenants allege against Beacon Property Management and Brand Realty LLC in Columbus echoes the same blueprint: deferred maintenance, aggressive late-fee policies, rapid escalation to eviction, and strategic use of public dollars through rental assistance programs.

In theory, Columbus has tried to respond. In December 2024, Colmbus City Council passed more ordinaces to accompany the Housing for All legislative package, which included:

A 60-day notice requirement for rent increases above 5%

Source-of-income protections to prevent discrimination against voucher holders

Right to counsel for low-income tenants in eviction court proceedings

These reforms were hailed as historic first steps toward housing equity. But the reality on the ground tells a different story.

Housing for All does not stop landlords from filing evictions over minor disputes.

It does not require landlords to repair homes before filing for eviction.

It does not cap the late fees that can turn small debts into insurmountable ones.

It does not create a public ownership registry to expose the true landlords behind LLC shields.

And it does not punish those who use eviction filings to trigger access to public aid.

In other words, it leaves the core machinery of displacement untouched.

Beacon and Brand continue operating without scrutiny.

Their filings go unchallenged.

Their tactics remain invisible to policymakers.

Their profits remain protected.

Not in court.

Not in public hearings.

Not in policy.

And every day that invisibility persists, the system they exploit grows stronger — pushing more families to the brink, turning homes into commodities, and transforming eviction into the most reliable return on investment Columbus real estate can offer.

Who Pays the Price?

The ripple effects of an eviction filing are immediate, brutal, and lasting. Families don’t just lose their homes. They lose their stability. Their savings. Their mental health. Their children's routines. Their foothold in the economic ladder.

An eviction filing — even if ultimately dismissed or settled — sets off a cascade of losses:

Jobs are lost, as court dates and emergency moves upend work schedules.

Possessions are abandoned, hastily packed or left behind on curbsides during court-ordered set-outs.

Credit scores plummet, buried under unpaid rent, court costs, and mounting debts.

Children are uprooted from schools, losing access to familiar teachers, friends, and critical support services.

Mental health deteriorates, as the stress of instability compounds into anxiety, depression, and long-term trauma.

Eviction isn’t simply a temporary setback. It’s a sentence — one that can shadow a family for a generation.

Once filed, an eviction becomes a permanent record, scraped by private tenant-screening companies and sold to landlords nationwide. Even tenants who win their cases, or pay what they owe, or leave voluntarily, find themselves branded as "high-risk" — disqualified from safer, better housing, pushed into predatory leases, substandard units, or forced into overcrowded shelters and unstable arrangements.

And it is not happening randomly. In Franklin County, as in most American cities, eviction operates along the sharp lines of race, gender, and economic vulnerability.

Black families are overrepresented in eviction court at rates far exceeding their share of the population.

Single mothers with children are the most likely to face filings, regardless of income level or payment history.

Working-class tenants, even those with full-time jobs, are disproportionately targeted.

These are not statistical quirks. They are the direct consequences of a system that monetizes instability, criminalizes poverty, and uses eviction not merely as a remedy for unpaid rent, but as a mechanism of extraction and social control.

Landlords file not because tenants have failed, but because tenants — especially Black tenants, single mothers, low-wage workers — are easier to push out, harder to defend, and more profitable to replace.

The end result is a vicious cycle:

Evictions drive poverty.

Poverty drives evictions.

Each filing tightens the noose — until housing insecurity becomes a permanent, inherited condition, passed from parent to child, family to family, generation to generation.

In Columbus, eviction doesn’t just rearrange who lives where.

It rearranges the future.

And unless the machinery behind it is dismantled — unless transparency, accountability, and human dignity are built into every corner of housing policy — the families paying the price today will not be the last.

They will only be the beginning.

The Next Phase

This investigation is not over. It is only beginning.

Every week, more tenants come forward.

More leases.

More locked portals.

More notices taped to front doors in the early morning silence.

More families navigating a system that was never built to help them stay — only to manage their removal.

The pattern is becoming undeniable.

It cuts across neighborhoods and income levels, across age and circumstance.

It reveals a machine operating not in the margins, but at the center of Columbus’s rental economy: a machine that turns vulnerability into profit, crisis into business opportunity, eviction into just another line item on a quarterly report.

This is more than a housing crisis.

It is a business model — precise, practiced, and largely invisible to the very policymakers tasked with addressing it.

Columbus cannot fix what it refuses to name.

And unless the city is willing to confront the full architecture of displacement — the ownership cloaking, the legal fast-tracking, the public-aid funneling, the strategic weaponization of eviction filings — the cycle will not break.

Thousands more families will face what the Taylors faced:

Locked out of negotiation.

Dragged into court not for failure, but for financial expediency.

Marked permanently by a system designed to erase them from the neighborhoods they once called home.

And they will face it with fewer resources.

With fewer allies.

With fewer exits left open.

Because in Columbus — as in so many American cities — eviction isn’t a tragic exception.

It isn’t a glitch in the system.

It is the system.

It is the strategy.

And for those who profit from it, the business model is working exactly as designed.

SO eye opening. Brilliantly researched & written. This 2-part article details one of the many racist atrocities that we knew must be happening across the country - & sheds light on the eviction rationale & process with concrete evidence & historical context. Thank you, we'll done👊🏾✊🏾